At the devcom developer conference in Cologne, Germany, Valve’s Erik Peterson took the stage to present Steam 2025 Platform Update. Drawing on his seven years at Valve supporting developers and publishers—as well as 13 years at Nintendo of America—Peterson offered a comprehensive look at Steam’s new features, growth trajectory, and opportunities for developers.

Steam’s Direction and New Opportunities

Peterson explained that Steam continues to focus on connecting developers with players, with special events ensuring that games of all types can find visibility throughout their lifecycle.

Steam’s four major seasonal sales remain critical touchpoints, and in 2025 the Autumn Sale has been shifted to early September to better balance timing across the year. Themed festivals are also expanding: 18 are already planned for 2025, with even more experimental events set for the first half of 2026—including offbeat concepts such as “Horse Fest.”

Steam Next Fest, now held three times annually, has solidified its role as a showcase for upcoming titles. Participation is free but limited to once per game pre-launch, making timing and preparation essential. A Store page and a demo build are required to take part.

Beyond Valve’s own events, third-party organizers ran around 200 events on Steam in 2025, some of which earned placement on the front page thanks to strong community interest. Developers interested in hosting their own events are encouraged to apply for support.

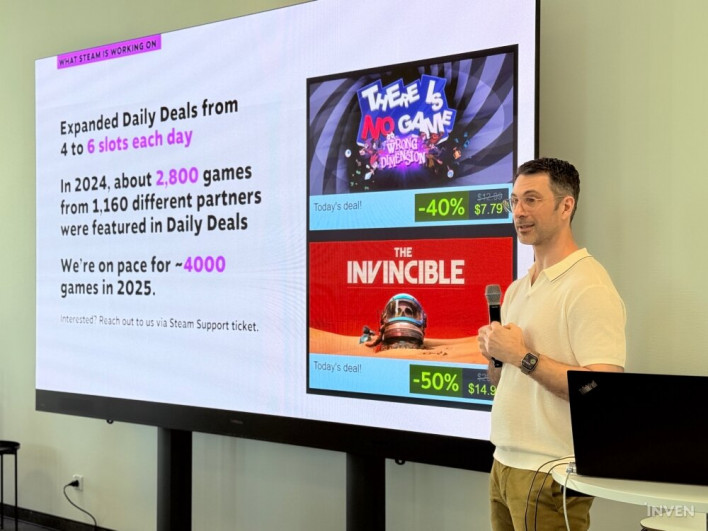

Daily Deals are also scaling up. Slots expanded from two to six, and by 2024 over 2,800 games from 1,160 partners were featured. By 2025, roughly 4,000 titles are expected. Notably, nearly nine out of ten featured games in 2024 were first-timers, reflecting Valve’s push to highlight a wider range of developers.

Accessibility is another focus. A new system now lets developers mark accessibility features on Store pages, helping players easily find games that meet their needs. This is only the initial version, with further improvements planned.

New Tools for Developers

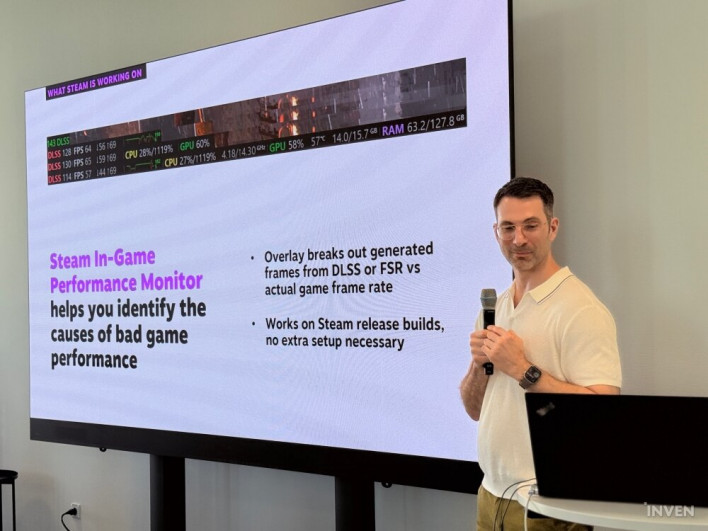

Valve has released an in-game performance monitor designed to help identify performance issues. It can separate frames generated by technologies like DLSS or FSR from native frames and runs directly within Steam release builds—useful for QA and playtests without extra setup.

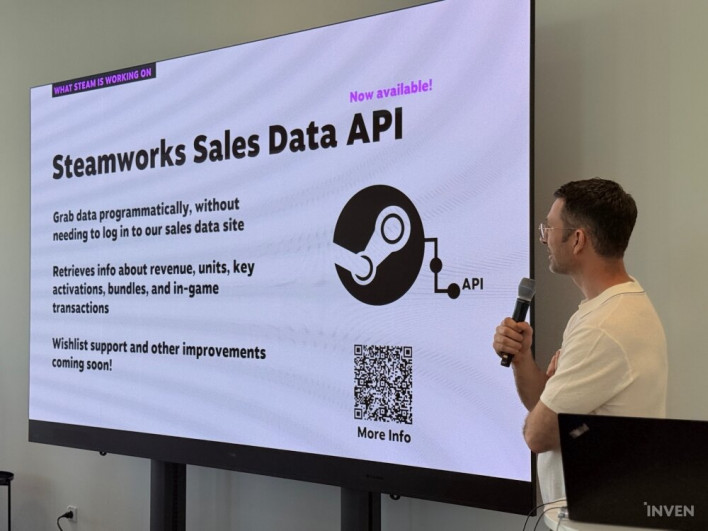

After years of developer requests, the Steamworks Sales Data API is finally live. It allows teams to pull sales, revenue, key activation, bundle, and in-game transaction data programmatically. Wishlist data and more features will follow in later updates.

The Steam Store’s front page has also been redesigned, with enhanced search, integrated browsing for popular hubs, and personalized recommendations consolidated at the top menu.

Peterson noted that Steam Deck has become a major success, with millions of units in circulation and steady developer adoption. Over 500 updates have shipped since launch, and Valve continues to invest in the platform. Developers also use the device as a mobile dev kit, even running playtests during flights.

Localization, Reviews, and Store Improvements

Several recent and upcoming features aim to refine the user experience. Steam Playtest now allows friend invites, enabling viral growth of test participants—especially valuable for multiplayer titles.

The Steam Trailer Player has been rebuilt with better quality, usability, and bandwidth efficiency. Older trailers may need to be re-uploaded to take advantage of the improvements.

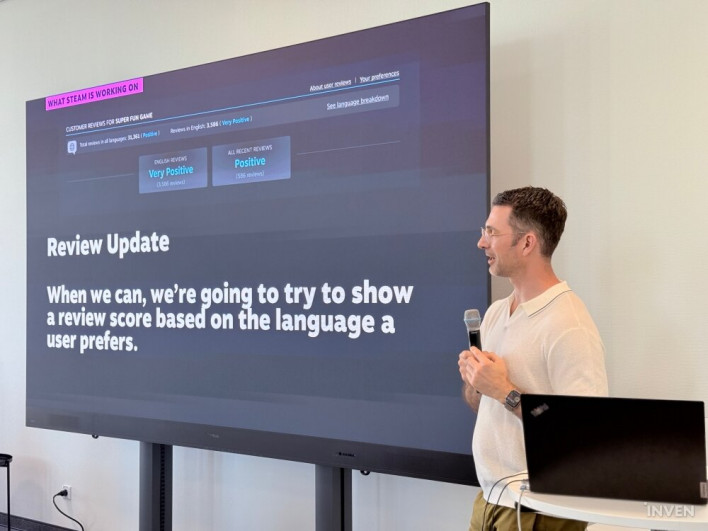

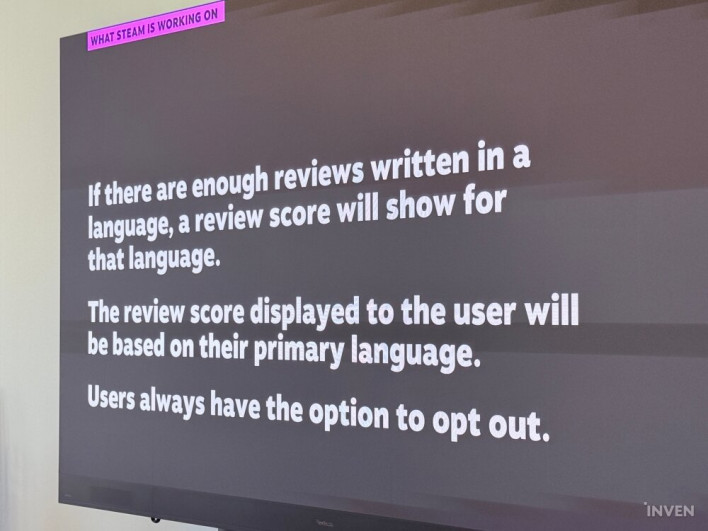

A major change is also coming to reviews: scores will now be weighted by the language set by the user. Since localization quality, cultural context, and even technical issues like network stability can significantly affect play experience, Valve believes this approach will give users a more accurate picture. Sufficient review data is required for language-specific scores to appear, and players will be able to analyze review breakdowns by language.

Growth at Record Levels

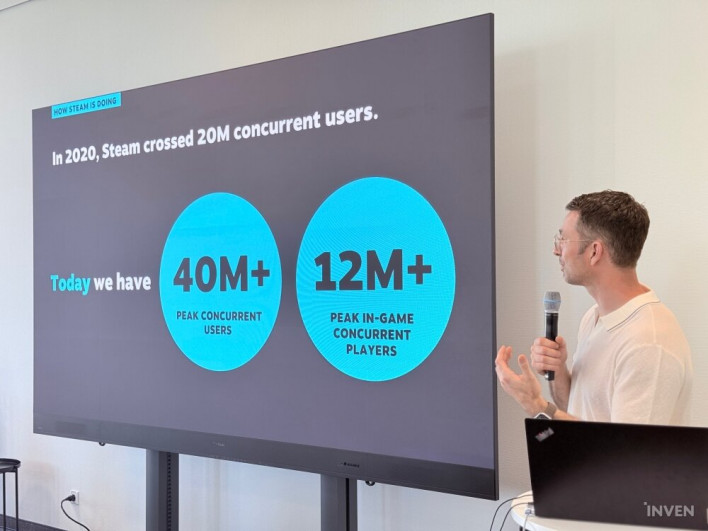

Peterson shared numbers underscoring Steam’s extraordinary growth. Concurrent users have doubled since 2020, surpassing 40 million, with peak concurrency exceeding 12 million.

From 2020 to 2025, Japan, Brazil, China, Germany, and the U.S. emerged as the fastest-growing markets. Japan’s growth is especially notable in light of its console-heavy history, while the U.S. market continues to expand despite its maturity.

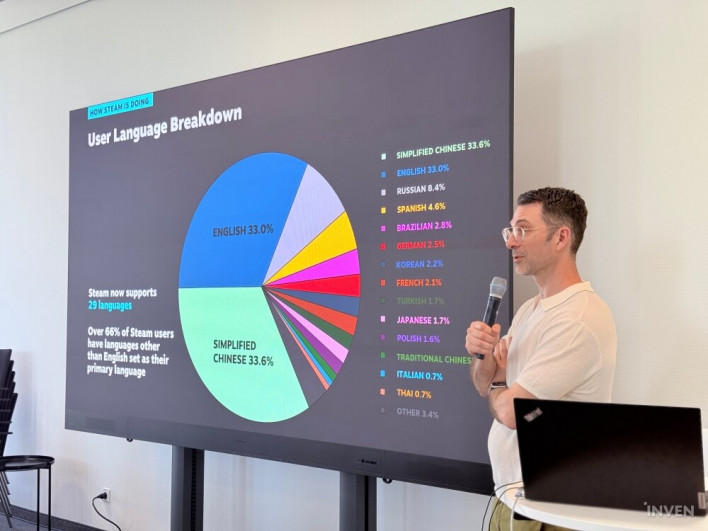

Localization has become indispensable: Steam supports 29 languages, and two-thirds of users set a non-English language as their primary one. Simplified Chinese leads the share, but the diversity across languages makes localization strategy critical for developers.

Between August 2024 and August 2025, Steam averaged 109,000 first-time buyers every single day—more than 75 newcomers every minute. Peterson illustrated this by comparing the daily inflow to filling Munich’s Olympiastadion and still having 34,000 people left outside.

Seasonal sales are also surging, with the 2025 Spring Sale up 19% and the Summer Sale up 8% year-over-year. These figures account only for discounted games, excluding free or full-price titles.

Launch revenues reached record highs in 2024: over 540 new releases surpassed $250,000 in their first 30 days (including pre-orders), and 224 exceeded $1 million. Analysis of the top 100 paid releases of the past four years revealed that more than half were priced under $50, and nearly a quarter under $30—evidence that successful games span every budget and scope, from indie to blockbuster.

Peterson concluded by stressing that Steam’s progress depends heavily on developer feedback. He reiterated Valve’s commitment to listening to developer input on new tools, features, and platform changes.

This article was translated from the original that appeared on INVEN.

Sort by:

Comments :0