In the ten or so months since Fortnite’s release, it has taken the world by storm. The vibrant battle royale shooter has come to completely dominate the genre, and its gaming content creators – streaming personalities like Ninja and Summit1G – have shattered viewership records left and right. It is perhaps the first game to so resoundingly infiltrate the mainstream media and to garner a mainstream audience, and, with every other breath, it is being touted as the next big esport.

But if esports veteran Andrey "Reynad" Yanyuk has learned anything in his fifteen years in the industry, Fortnite esports is not built to last. No esport is, in fact, nor game or genre of game. The way he sees it, it is the nature of gaming and esports to resist longevity.

Game titles, game genres, and gaming platforms are constantly in flux, and so too are corresponding esports. Although the esports industry is young and still developing, the lifecycle of a game has proven both predictable and, relative to traditional sports, short-lived.

Yet, longevity is the promise made by newly-minted esports franchises like the Overwatch League (OWL) and the League of Legends Championship Series (LCS), both of which drew interest and investment from owners of traditional sports teams. Blizzard Entertainment describes the former as an “esports ecosystem designed … to ensure that teams and players can thrive for years to come,” but if the esports trend continues, Overwatch’s honeymoon period has long passed and its esports boom is soon to bust.

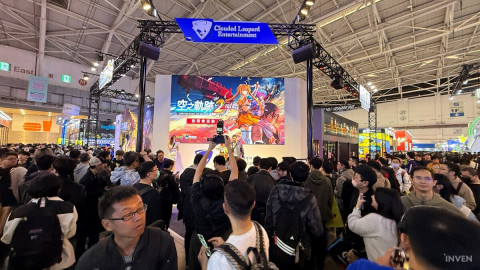

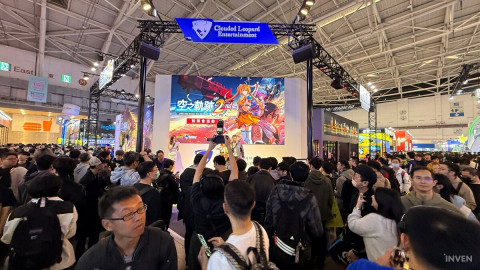

“A lot of the sports investors – at least the ones I spoke to over the last few years – they looked at esports as several different micro-sports, … [and] their strategy was to pick the right horse to bet on,” said Reynad, speaking at a panel at the 2018 Inven Global Esports Conference. “They want[ed] to pick the NFL [of esports] and avoid picking curling or... whatever.”

Except there is no – and most likely never will be – NFL or NBA of the esports industry because the gaming landscape is constantly, perpetually shifting. Ten or fifteen years ago, Starcraft II was the NFL of esports. It was not only the superlative esport, but a pioneer of the industry that helped build it from the ground up in more ways than one.

Now, the game is free-to-play and its esports scene is all but deceased. RTS, or real-time strategy, games have long since exited their boom period and are now languishing in their bust period. Fighting games, similarly integral to the foundation of esports, have also faded into the background of the industry.

The same can be said of MMOs – as Reynad noted, although World of Warcraft tournaments garnered tens of thousands of concurrent viewers as recently as 2012, the game and its esports scene are now dilapidated – and MOBAs. “League of Legends as a game [is] legendary in esports,” said Reynad. “Riot Games put in 100 times the production budget of anyone else in the space and just dominated it for years. They built stars; they built legacies; and, the organizations that were in that game since the early days [were] doing phenomenally up until today.”

League of Legends, as Reynad argues, is entering its own “stage three” – the bust or retraction period in every game and every esport’s lifecycle in which the player and viewer base shrinks to its core members. The core group itself waxes and wanes (e.g. World of Warcraft’s core player base in 2015 as it entered so-called stage three was larger than its existing core), but in the process of shedding its outer layers, each game (and corresponding esport) becomes less relevant and less profitable.

Shooters are now dominating the sister industries of esports and gaming, with RTS games, fighting games, MMOs, and MOBAs having enjoyed their time in the limelight. Battle royale in particular has usurped traditional FPS (first-person shooter) game modes, and it has done so with lighting speed.

“… esports is cyclical. Every game has a lifespan. And the platforms that are being played on, the games that are being played, are constantly in flux,” explained Reynad. “...as gaming trends change – [whether] because of technology or because of new releases – the fat gets trimmed from a game’s player base.

Understanding this cyclical nature of esports is vital to finding success within it. According to Reynad, the investors who are being sold on the idea of the next NFL or NBA have failed fundamentally to comprehend esports. The question at hand should not be which game to choose, but when to become involved with a game and how, or at what price. Flexibility and diversification are a company’s necessities.

Fortnite esports, the elephant in the room, does not actually exist. Its unparalleled, unequivocal success within gaming content has resulted in many a hasty declaration that the game is an esports phenomenon, but it in fact has yet to enter the space. It will soon, of course. In late April, Tencent, an investment conglomerate, invested $15 million into the Chinese Fortnite esports scene, and money is sure to flow in from every corner of the globe as endemic and non-endemic parties look to cash in on the biggest title in the world.

And those investments will be smart because the game is in stage one of its lifecycle – the boom period. Casual players and consumers are abundant, and the game’s novelty is high. Investing now allows any organization enough time to make a return on one’s investment before Fortnite and battle royale inevitably go the way of every title and genre: south. Within a few short years, the same $15 million investment Tencent recently made will be a mistake.

Such is the case with the League of Legends and Overwatch franchises. In 2014, a ten million dollar investment into the NA LCS would have been an “excellent investment,” says Reynad, but merely three years later, the same price tag is a money sink. Comparatively, although Overwatch is earlier in its lifecycle and thus lends organizations more time for growth, the Overwatch League overestimated its value at $25 million.

“It’s structured like a league, it’s something familiar to [non-endemic investors], it’s something that they understand. And it’s something that they were sold on, in a lot of places, as a real estate play,” said Reynad. “A lot of these guys didn’t expect to make that 25 million dollars back in cash, but they expected to have the asset of that league spot appreciate in value over time. [But the Overwatch League] is not Manhattan real estate. It’s Maldives real estate.”

Meaning, of course, that growth is not exponential and wanes in popularity are inevitable. The Overwatch League’s days are numbered not because the league is a poorly executed or a failure, but because it was developed and introduced too late in Overwatch’s lifecycle at too high of a price. There is little time to build a substantial brand that will endure long-term, and brand building, Reynad argues, is the true return on one’s investment.

“The real estate is not that league slot. It is the brand that you build along the way. It’s the Cloud 9 logo, it’s the TSM logo – that’s the real estate,” he explained.

From a business perspective, long-term sustainability does not require undying commit to and investment in one title or one franchise. Long-term sustainability requires an awareness of the cyclical nature of esports, and an ability to recognize when and how to enter a game – or, perhaps, when to leave it.

Sort by:

Comments :0